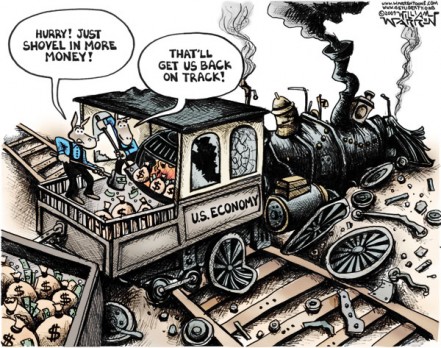

The year 2011 started on a happy note for the most of the world economy and most of us expected the year to be the one which will bring back our lives to normal(at least on the financial front). But it seems that last couple of months has destroyed all hopes. So let me take you back to the happenings on the economic front if you haven’t noticed the turmoil in the global markets. The entire series of incidents started from the tsunami in Japan which brought gargantuan devastation and along with a hiccup in the already problem facing economy. While it rocked Japan, an economic storm was brewing in the west. The smaller members of the Euro zone didn’t seem to have learnt anything from Portugal’s problems and their overspending had now brought their daddies, Germany and France(who used to bail them out) into serious problem. With France on the brink of getting into serious financial problems, it may so happen that we will see an end to Euro as a common currency for Euro zone. Having said all this, the meltdown was finally sparked as usual by the largest economy of the world, the United States whose petty political battles caused more problems than what any of us could have expected. The downgrade of U.S debt triggered a huge collapse across the stock markets of the entire world.

At this stage many of you might have this question in mind as to how is all this relevant to you. A lot of you may feel that countries like India and China are not going to be affected by any meltdown, but I think you should ask yourselves whether it’s true anymore or not. The Sensex is down by almost 10% from its pre July levels. Our growth rate has gone down to 7.8% for the last quarter down from an expected growth of more than 8.2%. The inflation rate has in no way seemed to respond to the efforts of the R.B.I and the industries have already started whining about its effect on industrial growth. China is getting into serious troubles because of its extremely liberal debt policy during the recession and the number of loan defaults has suddenly risen for many major banks of China like the China Development Bank.

Is all this beginning of a new recession? Are we going into a double dip? The answer is that no one knows. The situations seem to be pretty worse now but there are serious indications from various other economic indicators that at the moment we should keep our fingers crossed. Only the way in which the problems of China and France (or we shall say the Euro zone) unfold is going to decide the future.

I received very good information from website

Hahaahha. I’m not too bright today. Great post!